Cavalier Shipping insights on the current shipping finance market and recent events in the shipping space.

Join us on Substack to get posts delivered directly to your inbox.

The 2025 Shipping IPO You Didn’t Hear About

With current uncertainty around global trade given the U.S. administration’s policy disruptions, now seems like an odd time for a shipping company to pursue a public listing in New York.

America’s Last Competitive Advantage in Global Shipping

There’s growing concern over America’s shrinking footprint in global shipping—but one strategic edge remains: Wall Street.

Barbarians at the Gate?

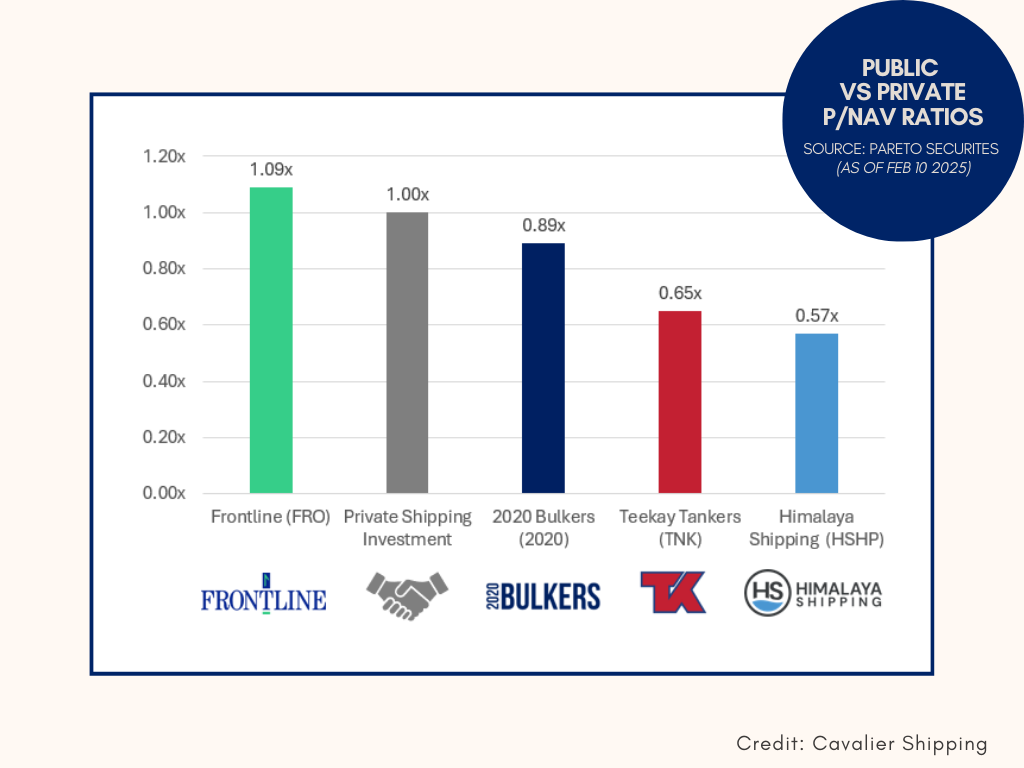

Activist investors largely overlook the shipping industry, but that could begin to change as companies aggressively repay their loans while trading at steep discounts to their net asset value (NAV).

What American Shipping Needs

As the U.S. looks to rebuild its maritime industrial base, there’s a lot of talk about needing an Elon Musk-type wealthy entrepreneur figure to swoop in from the tech sector and save American shipping.

America’s New Maritime Strategy to Grow the U.S. Flag Fleet

By exempting U.S.-flagged ships from carbon levies and bolstering domestic subsidies, Washington is sending a clear one: the U.S. fleet is open for business again.

Panel Recap: Follow the Money at CMA Shipping

While the panel acknowledged the rough seas ahead, there was consensus that the increased attention the shipping industry is receiving today is a positive indicator for attracting long-term investor interest and capital into the sector.

For Ship Operators, Volatility is Opportunity

In shipping, volatility isn’t noise—it’s opportunity. And in flat markets, even the sharpest traders can struggle to make the math work in their favor.

Investing, Trading, or Gambling?

Is the role of a public shipping company to compound value over time, or to simply serve as a trading vehicle for investors looking to opportunistically play the industry’s infamous cycles?

Style Drift: The Cost of Teekay and Scorpio’s Foray Into Other Tanker Stocks

What should a public tanker company do with its excess cash in today’s market? The answer for two prominent tanker companies: invest in other publicly listed tanker companies.

American Political Optics vs. Shipping Logic

Leaked messages from the recent “Signalgate” controversy underscore an uncomfortable truth: senior US policymakers continue to misunderstand—or disregard—the structural realities of global shipping.

New U.S. Trade Representative Fines | Consequences in the Caribbean

These USTR fines, designed to target China’s shipbuilding dominance, inadvertently places Caribbean economies and smaller carriers at significant economic risk. The Bahamas and neighboring island nations, having minimal influence over vessel sourcing, face unintended but severe economic consequences.

Platform Supply Vessels (PSVs) in Paradise

Following the oil price crash from 2014-2016, many PSVs became redundant in their original roles. Fortunately, several have found new purpose in serving the unique maritime logistics needs of the Bahamas.

Quid Pro Quo? CMA CGM’s $20 Billion Investment in US Shipping

CMA CGM's $20 billion pledge may be strategically timed to mitigate potential financial damage from a proposed policy targeting shipping operators with significant numbers of Chinese-built vessels, or who have ordered vessels from Chinese shipyards.

The End of an Era | John Fredriksen Exits Golden Ocean

With two fewer public shipping companies under Fredriksen’s control in a matter of months, speculation is growing. At 80 years old, is JF—the man known simply by his initials—strategically unwinding one of the most remarkable single-generation shipping empires ever built?

Why Vessel Prices Remain Stubbornly High

Just as inflation in everyday goods can persist when consumers have more disposable income, ship prices can remain elevated when their natural buyers—shipowners—are flush with cash.

US Navy Shipbuilding - Up Next for Department of Governmental Efficiency?

As U.S. government spending scrutiny intensifies under the Trump Administration, the Navy’s shipbuilding budget may be up next for examination at Elon Musk’s Department of Governmental Efficiency.

US Offshore Wind Casualties

Polarizing legislation like the Jones Act can make for unlikely allies.

BDRY: A Valuation Unicorn Among Public Dry Bulk Shipping Stocks

Unlike most publicly-listed dry bulk shipping companies, the Breakwave Advisors Dry Bulk Shipping ETF (BDRY) trades at a slight premium. Public dry bulk shipping companies on average trade at a 25% discount to their net asset value (NAV) yet BDRY stays close to its NAV. How can this be?

Comparing Public and Private Shipping Company Valuations

Public shipping companies’ end valuations are far more variable than private shipping companies’, since the latter group doesn’t have the constant mark-to-market pricing mechanism of public markets–P/NAV–as a factor.

Shipping’s Illiquidity Premium

Is a 2% premium enough for investors to restrict their ability to quickly exit their bets in order to take profit (or minimize losses)?